financial Services

Full-Scope Annual Retainer Engagement Service

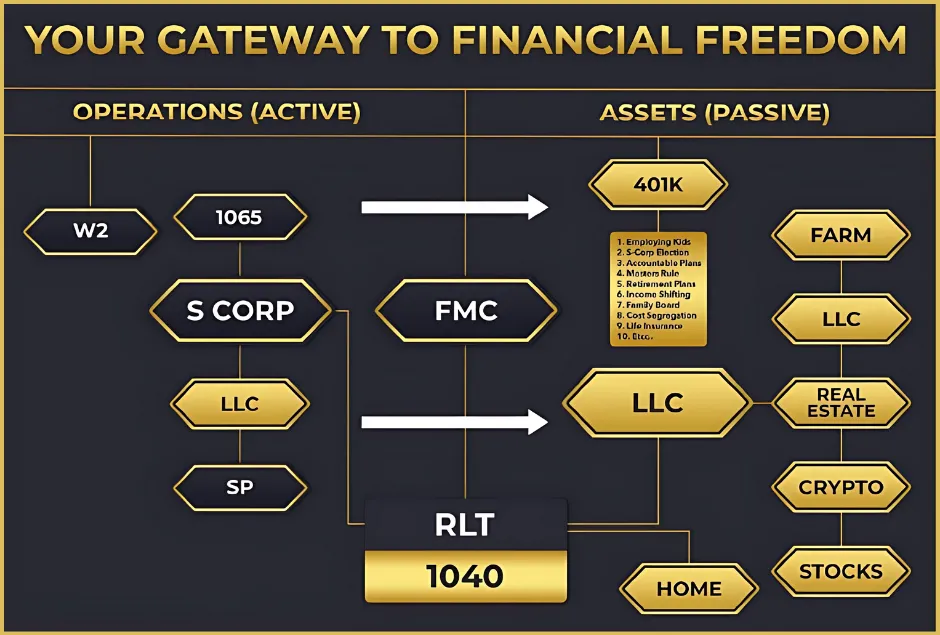

Our retainer model provides year-round access to tax, estate & wealth strategy in a single, integrated framework. Rather than managing multiple advisors, you have one unified team delivering structure, filings, coordination and stewardship — so you save time, reduce risk and unlock structural value.

W2 EARNERS / HIGH INCOME EARNERS

Service List Below

Tax Saving Strategy Implementation

IRS Representation

Entity Formation (including Loan-out)

Self-Employed Investment Setup (SEP IRA, Solo 401k)

Payroll Services

Bookkeeping Services

Estimated Tax Payments

Personal/Business Cash Flow Planning

Investment Management

Debt Management

Financial Planning

Tax Preparation (additional cost)

BUSINESS OWNERS

Service List Below

Tax Saving Strategy Implementation

Entity Formation (including Loan-out)

Entity Maintenance and Compliance Services

Self-Employed Investment Setup (SEP IRA, Solo 401k)

Business Advisory (Business Analysis & Projections)

Payroll Services

Financial Reporting (Balance Sheet & Income Statements)

Bookkeeping Services

Estimated Tax Payments

Personal/Business Cash Flow Planning

Investment Management

Tax Preparation (additional cost)

If You make less than $300,000 and you're saying to yourself, I'm not quite ready to work on a long-term basis, however, I Still have a few pressing financial/tax questions that I'd like help on. What should I do?

Answer: Try our American Dream Blue print plan

What the session includes:

Two 60–90 minute video sessions (Data gathering and Plan Presentation & Implementation)

An in-depth discussion of your 2–3 most pressing financial topics, with example questions such as:

How can I organize my business finances or set up business accounts?

Do I need an S-Corp or loan-out company? Can you create it for me?

Includes formation, EIN, and payroll setup

Can you help lower my tax bill?

How do I calculate quarterly tax payments?

Can you set up my investment account and manage my investments?

Can you help me plan out my large payout?

Help me get organized for taxes and prepare taxes (**)

(** means this is stand-alone service)

Any money spent on these plans can be applied toward Retainer Services within 3 months.

COMPREHENSIVE TAX AND WEALTH SOLUTIONS

From tax planning to estate strategies, business structuring, and wealth management, CHN Advisors provides everything you need to legally reduce taxes, protect assets, and build long-term financial confidence.

FOLLOW US

COMPANY

CUSTOMER CARE

Copyright 2026. CHN CPA & ASSOCIATES. All Rights Reserved.